Frequently Asked Questions about California Notary Bonds and Insurance

1. Why do I need a notary bond?

2. What is the difference between a notary bond and a notary errors and omissions policy?

3. What should I buy?

4. Why Travelers?

5. If I don't purchase insurance now, can I add it later?

6. If I purchase insurance now, can I increase my limit later?

7. Can I buy any other surety bonds from you?

8. Where can I get more notary supplies?

9. How are you related to Notary.net, Notary Rotary, Notary Learning Center and others?

10. How can I keep from getting sued?

11. I already have general liability insurance. Won't that protect me?

12. May I order a Travelers notary bond and E&O insurance policy by mail?

1. Why do I need a notary bond?

You are required by California law to file a $15,000 notary surety bond with your county when you take your oath. The bond protects the public from you.

2. What is the difference between a notary bond and a notary errors and omissions policy?

A notary surety bond is a type of financial obligation that exists to protect the public from harm that you may cause in your role as a public servant. There are three parties to a surety contract:

- principal: that's you, the notary public

- surety: the bonding company (e.g. Travelers or Merchants Bonding)

- obligee: the party that's protected by the bond (the people of California)

A notary errors and omissions insurance policy helps protects you from a) Claims made on the bond, and b) Lawsuits that are brought against you. Subject to policy limits and provisions, the E&O policy will provide a legal defense and/or pay damages to third parties, including reimbursement for money paid by the surety in connection with your bond.

In California, the notary bond is required. The errors and omissions policy is optional, but strongly recommended.

3. What should I buy?

Ultimately, it's up to you. But once you understand the difference between a bond and a notary E&O policy, the choice should be clear: purchase a bond, because it's required, and purchase as much E&O insurance as you can reasonably afford based on the volume and type of work you do.

4-year $15,000 Bond + 4-yr $100,000 E&O Coverage Best Value & Most Protection

- Recommended for professional and high-volume notaries

- Recommended for notaries dealing with real property and transactions involving money

- $100k E&O for a little less than $0.12 per day

4-year $15,000 Bond + 4-yr $25,000 E&O Coverage

- Good bang-for-the-buck option

- Will cover most small claims

4-year $15,000 Bond + 4-yr $15,000 E&O Coverage

- Minimum recommended amount

- Will at least provide for reimbursement of claims made on your bond

4. Why Travelers?

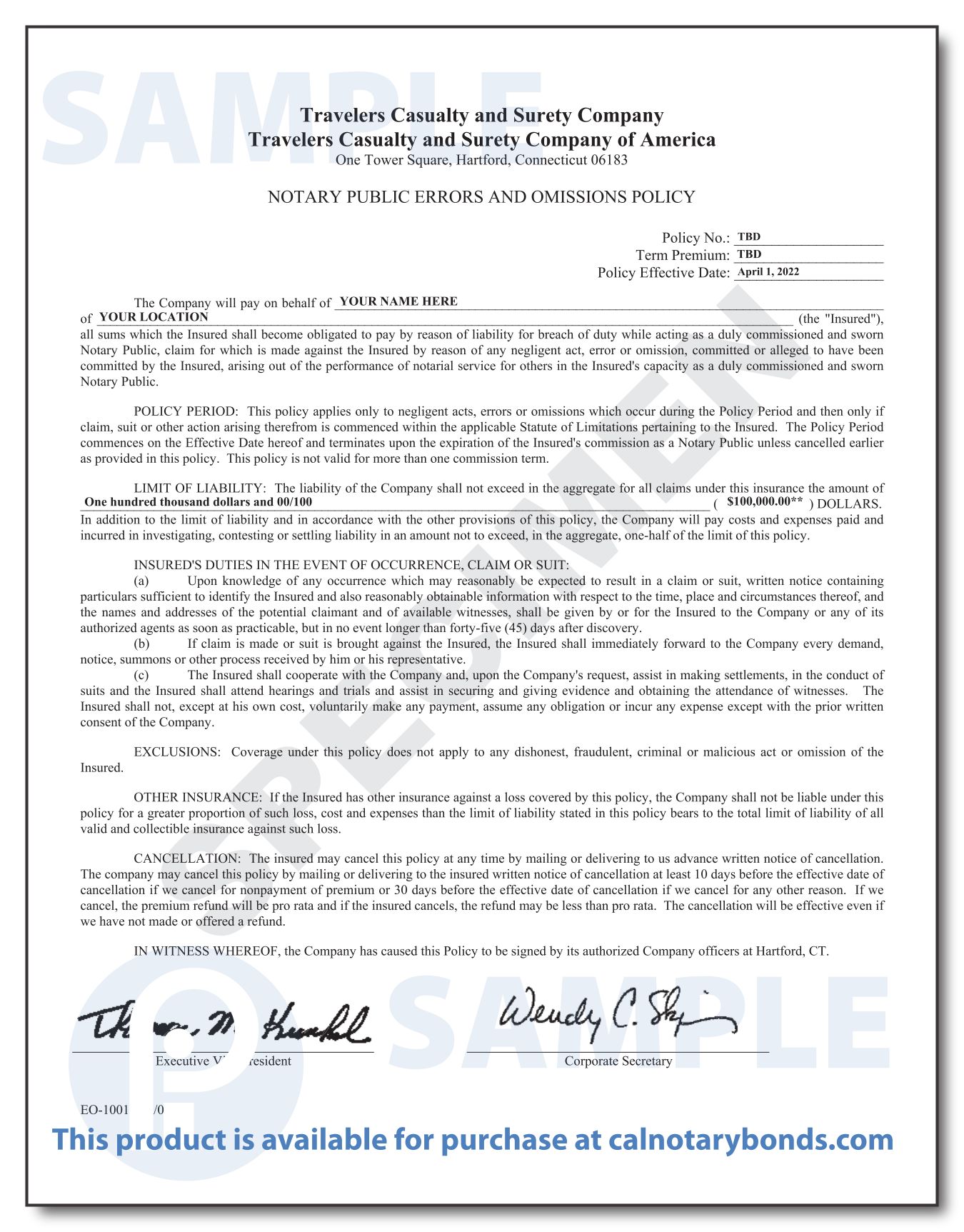

Travelers has a very strong financial stability rating (A++ AM Best), great notary errors and omissions insurance rates in California (less than half the cost of other popular $100,000 policies), and covers defense costs outside of policy limits limited to 50% of the coverage amount. This means a $100,000 Travelers policy could pay $100,000 in damages AND $50,000 in legal fees, for a total payout of $150,000. Other $100k policies may include defense costs inside policy limits, limiting you to $100,000 to cover both damages and fees.

Here's an example of what your Travelers E&O policy will look like (if you can't read it, try zooming-in using your browser by pressing Ctrl+ repeatedly):

5. If I don't purchase insurance now, can I add it later?

Sort of. You will never be able to get back-dated insurance (for example, purchasing in the future for coverage beginning today), but we can sell you an E&O policy in the future to begin on a future date. Note that the policy will probably be more expensive than the Travelers policies, so please consider purchasing something now if you believe you will ever need more professional liability insurance.

6. If I purchase insurance now, can I increase my limit later?

Yes, for a while, anyway. But it's much better to purchase the amount you feel you may need in the future now.

7. Can I buy any other surety bonds from you?

Sure! We also sell tax preparer bonds, immigration consultant bonds, legal document assistant bonds, lost title bonds, motor vehicle dealer bonds, court and probate bonds, contractor license bonds, payment and performance bonds, and many more! Please contact us about your specific bonding needs.

8. Where can I get more notary supplies?

Check out Notary.net, Notary Rotary, and Notary Learning Center for the Modern Journal of Notarial Events, AccuPrint print pads, and more!

9. How are you related to Notary.net, Notary Rotary, Notary Learning Center and others?

CalNotaryBonds.com is a service of Performance Surety Bonds and Insurance Services, an independent insurance agency. Notary.net, Notary Rotary, and Notary Learning Center are business partners. We may refer our customers to them for notary training and supplies, while they sometimes refer to us for a streamlined bond and insurance purchase experience.

10. How can I keep from getting sued?

In short, follow the law: require personal appearance, properly verify identity, properly execute all notarial certificates, and keep accurate records in your notary journal.

11. I already have general liability insurance. Won't that protect me?

For the most part, general liability insurance protects your clients from physical injury and injury to their reputation that you may cause through defamation. These types of personal injuries are not the same as professional injuries you may cause through errors or omissions. For that, you need a professional liability or errors and omissions insurance policy. In most cases, other professional liability policies will not cover your notarial mistakes.

12. May I order a Travelers notary bond and E&O insurance policy by mail?

Yes you may! Click here for our California notary bond and errors and omissions insurance order form. You must have Adobe Acrobat Reader to view it.

© 2016-2026 Performance Surety and Insurance Services. California insurance license number 0K59197. All Rights Reserved.